TL;DR: Understanding auto insurance policies is crucial for effective frame repair claims. Comprehensive or collision benefits usually cover basic structural restoration, but severe accidents or older vehicles may incur hidden costs like specialized parts and labor. Clear communication between repair specialists, facilities, and insurers is vital to avoid misunderstandings. When claims are denied, policyholders have rights; examining denial notices, gathering evidence, and negotiating with insurers can lead to settlements covering necessary frame repair work.

Many car owners believe that their insurance covers any and all repairs, including frame damage. However, insurers often deny frame repair claims due to hidden costs not explicitly covered in policies. This article delves into the intricacies of insurance policies, exploring what constitutes frame repair coverage and how insurers might exclude certain expenses. We uncover hidden costs commonly left out and guide policyholders on navigating claim denials, empowering them with knowledge about their rights and available options when dealing with frame repair for insurance claims.

- Understanding Insurance Policies and Frame Repair Coverage

- Unveiling Hidden Costs: What Insurers Might Not Reveal

- Navigating Denial of Claims: Rights and Options for Policyholders

Understanding Insurance Policies and Frame Repair Coverage

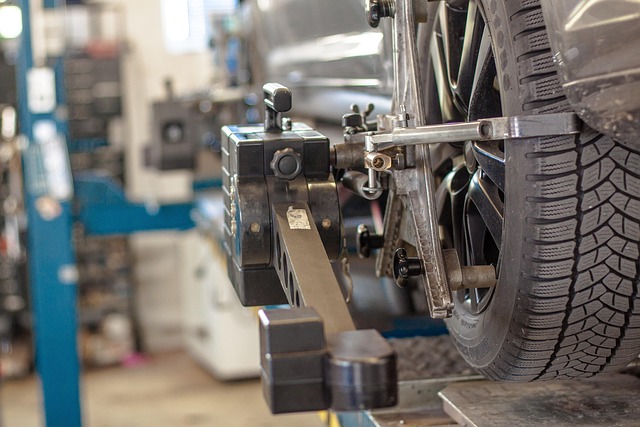

When it comes to insurance claims for vehicle damage, understanding your policy is paramount. Many standard auto insurance policies include coverage for frame repair as part of their comprehensive or collision benefits. This coverage is crucial in ensuring that structural integrity is restored after an accident, preventing further complications down the line with the car’s safety and performance. Frame repair for insurance purposes typically covers the costs associated with realigning and replacing damaged components of a vehicle’s chassis, which is essential for proper functioning.

However, hidden costs can often arise during frame repair processes, especially when dealing with complex damage from severe accidents or older vehicles. These hidden expenses might include specialized tools, labor-intensive techniques required for precise adjustments, or the need to acquire and install genuine parts. Auto dent repair specialists and auto collision repair facilities must communicate clearly with insurance providers about these potential costs to avoid misunderstandings and ensure a seamless claims process.

Unveiling Hidden Costs: What Insurers Might Not Reveal

When it comes to insurance claims for frame repair, one often encounters hidden costs that can catch policyholders off guard. What many drivers don’t realize is that insurers might not initially disclose all the expenses associated with such repairs. This can lead to surprise bills after what seemed like a straightforward claim process.

Frame repair for insurance purposes often involves more than just straightening and painting. It may include components of auto maintenance, such as replacing damaged suspension parts, aligning wheels, or even reinforcing the car’s structure. These additional costs are crucial to consider, especially in cases of severe vehicle collisions. The complexity of modern car bodywork means that a seemingly simple frame repair could turn into an extensive and costly endeavor, highlighting the need for policyholders to be aware of potential hidden fees during their claim journey.

Navigating Denial of Claims: Rights and Options for Policyholders

When an insurance claim for frame repair is denied, policyholders have rights and options to consider. The first step is to thoroughly review the denial notice, understanding the specific reasons behind the rejection. This might involve scrutinizing the assessment reports from the insurer’s appraisers, who may have identified hidden costs or structural issues that impact the cost of repairs. Frame repair for insurance claims can be complex due to these potential hidden expenses, often related to car bodywork damage from a collision.

Policyholders are entitled to challenge the denial and seek clarification from their insurance provider. This process typically involves gathering additional evidence, such as estimates from reputable collision repair centers or auto body repair shops, that accurately reflect the extent of necessary frame repairs. Engaging directly with the insurer is crucial, ensuring open communication to resolve any discrepancies and potentially negotiate a settlement that covers the required frame repair work.

While insurance policies often provide coverage for frame repairs, policyholders must be aware of potential hidden costs that could lead to claim denials. Understanding your policy and being vigilant about these concealed expenses are key to ensuring a smooth claims process. By staying informed and knowing their rights, individuals can effectively navigate any challenges when seeking frame repair through insurance, ultimately achieving the necessary repairs for their vehicles.