Understanding your insurance policy is crucial when considering frame repair for insurance claims. Modern vehicles often have advanced safety features and cost-effective alternatives like paintless dent repair. Auto detailing services can also restore pre-accident condition. Reviewing your policy's clauses and deductibles regarding structural damage is vital to avoid financial surprises or claim denials. Keeping detailed records of communications, expenses, and invoices simplifies the claims process for frame repair, ensuring proper compensation.

Before you tackle any frame repair for insurance claims, make sure you understand your policy inside out. This concise guide is designed to help you navigate the process effectively. We’ll break down the importance of thoroughly reviewing your insurance policy, especially regarding what’s covered in frame repairs. By understanding these nuances, you can ensure a smoother claim process and avoid unexpected costs. Learn essential tips for successful frame repair for insurance, from pre-repair assessments to post-claim settlements.

- Understanding Your Insurance Policy: What Covers Frame Repair?

- The Importance of Comprehensive Reviews Before Repairs

- Navigating the Claims Process: Tips for Effective Frame Repair for Insurance Claims

Understanding Your Insurance Policy: What Covers Frame Repair?

Understanding your insurance policy is crucial when considering frame repair for insurance claims. Every policy is unique, and what’s covered can vary widely between providers and types of coverage. Before you initiate any repairs, take a deep dive into your policy to uncover the specifics of frame repair coverage. Some policies may include comprehensive or collision coverage, which can often help with frame-related damages, but always confirm the terms and conditions.

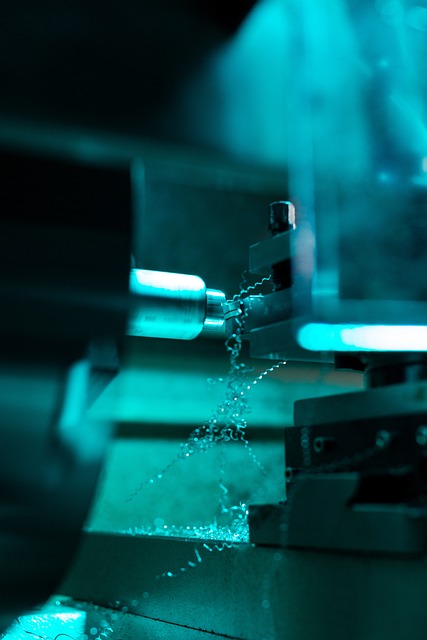

Many modern vehicles are equipped with advanced safety features that can mitigate the need for extensive frame repairs after an accident. Techniques like paintless dent repair offer a cost-effective alternative to traditional frame repair methods, saving both time and money. Similarly, auto detailing services can help restore your vehicle’s pre-accident condition, enhancing its overall aesthetics without directly addressing structural issues. Understanding these options alongside your policy coverage will empower you to make informed decisions regarding your vehicle’s repair.

The Importance of Comprehensive Reviews Before Repairs

Before engaging a frame repair for insurance, conducting a thorough review of your policy is paramount. Many policies have specific clauses and deductibles regarding structural damage, which can significantly impact the out-of-pocket costs you’re responsible for. A comprehensive review ensures you understand what’s covered and what isn’t, preventing unexpected financial burdens after the repair.

This process becomes even more critical when considering that frame repairs often involve intricate work to ensure vehicle safety and structural integrity. Misunderstanding your policy could lead to repairs not being fully covered, or worse, you might be denied claims altogether. By delving into these details now, you’re better equipped to choose the right collision repair center for auto body restoration, ensuring your vehicle is restored with minimal financial strain.

Navigating the Claims Process: Tips for Effective Frame Repair for Insurance Claims

Navigating the claims process for frame repair can be a daunting task, but with preparation and understanding, it becomes more manageable. Before initiating any frame repair work, thoroughly review your insurance policy to comprehend the coverage limits and deductibles associated with car damage repair, including frame-related incidents. Knowing what’s covered and what isn’t is crucial in ensuring you receive appropriate compensation for vehicle dent repair or structural frame damage.

When filing a claim for frame repair for insurance, maintain detailed records of all communications with your insurer. Document the date, time, and substance of discussions regarding your claim. Additionally, keep receipts and invoices from any tire services or car damage repair work undertaken. These documents are essential for verifying expenses and ensuring accurate reimbursement during the claims process.

Before embarking on any frame repair for insurance claims, it’s paramount to thoroughly review your policy. Understanding what’s covered can streamline the process and ensure you’re not left with unexpected costs. By navigating the claims process effectively, you can secure efficient repairs and maintain peace of mind knowing your investment is protected. Remember that a comprehensive review is a game-changer in managing frame repair for insurance, enabling you to make informed decisions every step of the way.