Accurate Frame Repair Assessment for Insurance Claims

When filing an insurance claim for frame repair, thorough damage assessment using advanced tools like CAD software and laser measurement devices is crucial. Underestimating structural harm can lead to delayed or insufficient reimbursement, unsafe vehicles, and rejected claims. Insisting on meticulous inspections by qualified professionals ensures accurate damage evaluation, aligning with industry standards and insurance expectations. This comprehensive approach prevents incorrect repairs, maintains safety standards, facilitates proper handling by authorized auto collision centers, and ensures policyholders receive adequate compensation for safe and cost-effective frame repair.

“Avoiding Pitfalls in Frame Repair for Insurance Claims: A Comprehensive Guide

Frame repair is a crucial step in the insurance claims process, but it’s not without its challenges. This guide highlights common mistakes to steer clear of when undertaking frame repairs. From misassessing damage to choosing the wrong contractors, each blunder can significantly impact your claim and restoration process. Learn how proper assessment, meticulous documentation, and informed contractor selection are key to navigating this intricate procedure successfully, ensuring a smoother journey towards restoring your vehicle.”

- Assessing Damage Properly

- – Understanding the extent of frame damage

- – Common misassessments and their implications for claims

Assessing Damage Properly

When filing an insurance claim for frame repair, accurately assessing the damage is paramount. Many policyholders make the mistake of underestimating the extent of the vehicle’s structural harm, which can lead to delayed or insufficient reimbursement. Thoroughly inspecting every angle and component of the frame ensures that all issues are documented and addressed during the repair process. This meticulous approach guarantees a complete restoration, aligning with industry standards and your insurance expectations.

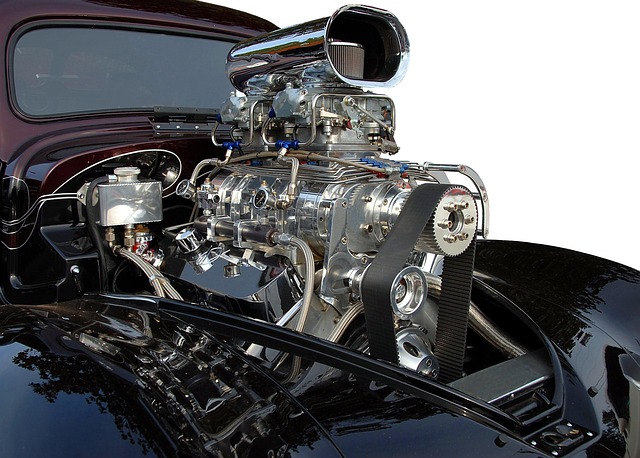

Proper assessment involves utilizing advanced tools and techniques to identify hidden damage, such as computer-aided design (CAD) software or laser measurement devices. Trained professionals should evaluate not just visible dents but also any misalignment in the frame, which could indicate more serious underbody issues. This meticulous approach to frame repair for insurance claims is crucial in receiving adequate compensation from your insurer and ensuring your vehicle’s safety and functionality after repairs are completed, whether it involves fender repair or more extensive body shop services.

– Understanding the extent of frame damage

When dealing with frame damage for an insurance claim, it’s crucial to understand the extent of the issue before attempting any repairs. Many mistakes arise from misjudging the severity of frame damage, which can lead to unsafe vehicles and rejected claims. Thorough inspection is key; examining the frame for dents, bends, or misalignments requires professional tools and expertise. Misdiagnosing a simple dent as a more severe problem could result in unnecessary auto dent repair costs and delays.

Proper evaluation ensures that only authorized auto collision centers handle the frame repair for insurance purposes. This prevents incorrect auto glass repair attempts and maintains vehicle safety standards. Remember, accurate damage assessment is the first step in ensuring successful insurance claims and high-quality repairs, avoiding costly mistakes in the process.

– Common misassessments and their implications for claims

Many insurance claims for frame repair often involve misassessments that can lead to delays and disputes. One common mistake is underestimating the extent of damage to the vehicle’s frame. A simple visual inspection might not reveal hidden issues, such as structural integrity compromises or corrosion, which could affect the safety and longevity of the vehicle post-repair. This oversight can result in subpar repairs, leading to further complications and increased costs for both the policyholder and insurer.

Another prevalent error is relying solely on aesthetic restoration without addressing the underlying mechanical and structural problems. A car damage repair that focuses only on making the frame look new might not ensure proper alignment or restore the vehicle’s original safety standards. Such missteps can have severe implications, especially in terms of handling and braking capabilities. Policyholders should insist on a comprehensive assessment by qualified professionals in a reputable vehicle body shop to avoid these pitfalls during their insurance claims for frame repair.

When dealing with frame repair for insurance claims, accurate assessment is key. Avoiding common mistakes like overlooking subtle damage or undervaluing repairs ensures a smoother claim process and faster restoration of your vehicle. By understanding the intricacies of frame damage, you can navigate the claims journey effectively, leading to a successful outcome.